Karachi, Septmeber 27, 2023: Digital transactions continued growth trajectory owing to the increased consumers’ preference for digital channels of mobile and internet banking for meeting their financial needs. Overall, mobile and internet banking transactions witnessed an annual growth of 57 percent by volume and 81 percent by value during the last fiscal year (FY23).

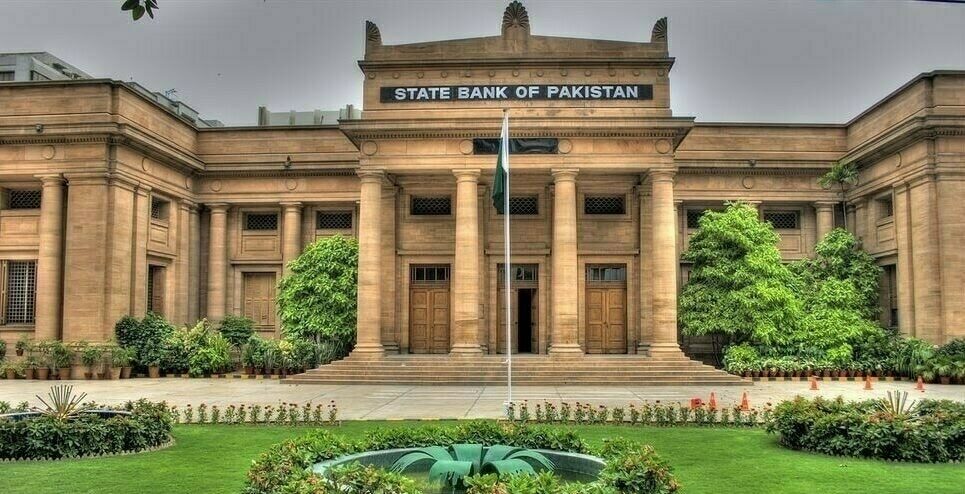

The annual Payment Systems Review for the fiscal year 2022-23 was released on Wednesday by the State Bank of Pakistan (SBP). The review presents growth and trends in banking transactions accompanied by the usage of payment systems’ infrastructure and instruments in the country.

During FY23, e-banking transactions contributed to 85 percent of total payments processed by banks and MFBs, while the remaining 15 percent were paper-based transactions. This percentage was 80 percent for e-banking and 20 percent for paper-based transactions in FY22 indicating customers are gradually adopting digital channels.

Further, e-banking transactions through Banks and Microfinance Banks (MFBs) grew by 29% while value increased by 21% during the year. A similar growth pattern was also observed in Branchless Banking (BBs) transactions with the number of transactions increasing by 28% and value by 45% during FY23.

Number of e-banking users also increased significantly. The year saw an increase of 15% in internet banking users, 30% in mobile banking users, and 42% in BB mobile app users. Electronic Money Institutions (EMIs) also contributed meaningfully to the inclusion of digital banking users by opening more than 2 million e-wallets since their inception.

The e-banking is attracting more customers due to its efficient and instant payment solutions, and its transactions are growing at a steady pace over the years. In contrast, paper-based transactions have declined by more than 4% during FY23 and cumulatively around 20% in the last five years. However, the value of paper-based transactions increased by 20% in FY23.

The Real-Time Gross Settlement (RTGS) system of Pakistan and Raast – Pakistan’s Instant Payment System, owned and operated by SBP, facilitates financial institutions and banking customers in processing and settling transactions. During the year, RTGS processed 4.9 million transactions amounting to PKR 640.4 trillion, while 155 million transactions were processed on Raast amounting to PKR 3.2 trillion during this fiscal year.

Financial institutions are also strengthening their e-banking infrastructure by expanding Point-of-Sale (POS) terminals, Automated Teller Machines (ATMs), Cash/Cheque Deposit Machines (CDMs), e-commerce merchants, and agents’ networks to meet customers’ needs. As of June 30, 2023, there were 115,288 POS terminals, 17,808 ATMs, 520 CDMs, and 6,889 e-commerce merchants for providing payment services to customers. During the fiscal year, the number of transactions through POS (199.3 million) and ATMs (809.7 million) grew annually by 45% and 17% respectively. Domestic e-commerce transactions using payment cards were 31.8 million which amounted to PKR 142 billion during the year.

As of June 30, 2023, there were 58.1 million payment cards in circulation of which 44.5 million were issued by banks and MFBs, 10.8 million by branchless banks, and 2.8 million by EMIs.