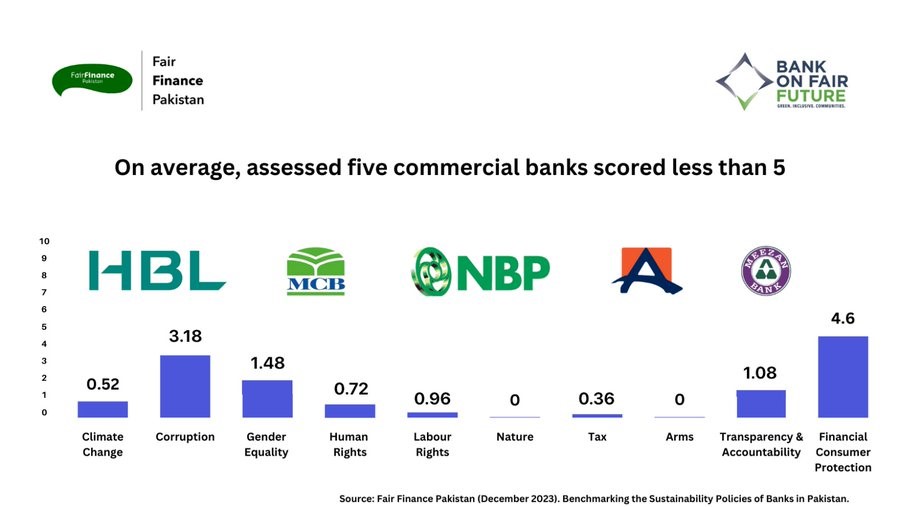

Islamabad, December 06, 2023: Policy rankings of five leading commercial banks in Pakistan “Benchmarking the Sustainability Policies of Banks in Pakistan,” show all five banks have low policy commitments on climate change, human rights, gender equality, and labour rights, while none disclose policies on nature and tax when lending money to companies.

Speaking at the launch, Senator Farhatullah Babar raised concerns on low scores of banks on human rights criteria and asked why banks do not disclose their policies in public domain which does not show their commitment towards transparency.

Fair Finance Pakistan assessed the sustainability policies of Habib Bank Limited (HBL), Allied Bank, National Bank of Pakistan (NBP), Meezan Bank, and Muslim Commercial Bank (MCB) across ten thematic areas in the Fair Finance Guide International (FFGI) Methodology, including climate change, corruption, gender equality, human rights, labor rights, nature, arms, tax, transparency and accountability and financial consumer protection.

The highest average scores are observed for the themes of financial consumer protection, 4.62 out of 10, corruption, 3.18 out of 10, gender equality, 1.48 out of 10, and transparency and accountability, 1.08 out of 10. For all the other themes, the average score for the five banks is inferior to 1 out of 10, which reveals a lack of public policies on most of the sustainability topics assessed.

The ranking is based on the FFGI Methodology used in 21 countries to assess financial institutions’ approach to sustainability including corruption, human rights and climate change. It was conducted with the support of Lahore University of Management Sciences (LUMS) and Profundo.

Asim Jaffry, Country Program Lead, Fair Finance Pakistan highlighted zero scores of top 5 commercial banks on nature and tax makes me think are these areas not a priority for banks or the regulator and are the financial institutions exempted from responding to national laws. He stressed, “Finance must be repurposed to address society’s challenges and must redouble efforts for clean air, clean water and save the liveable planet for our future generations.”

Hamza Sarosh, Senior Vice President, Rawalpindi Chamber of Commerce and Industry raised concerns during the panel discussion on Now and Next: Repurposing Finance and asked banks why SMEs get peanuts from big capital and are not priority for banks.

Participating through Zoom, Mirza Shakoor from Community Development Concern said industrialist hubs like Sialokot are not on the priority list for lending by banks which hampers economic growth.

Mukhtar Ali from Center for Peace Development Initiatives strongly recommended banks in Pakistan must adopt clear policies on non-financial disclosure in line with Article 19 of the constitution Right to information, and disclose policies related to investment and financing to address climate change and human rights concerns.

Five Pakistani commercial banks’ sustainability commitments

Chief Guest Mr. Ashfaq Tola, former Minister of State and former Chairman of RRMC recommdned during the policy rankings launch for banks to pay attention on sustaiabinlity policies for transitioning the economy.

Ume Laila, Executive Director, HomeNet said the Regulator has made positive strides to incentivize businesses and sensitize on gender equality principles which shows commitment.

Nadeem Iqbal, CEO, TheNetwork for Consumer Protection Banks highlighted banks must disclose information about its activities related to investments and financing and establish grievance mechanisms to address human rights, labour rights and financial consumer protection concerns.

Large gaps on Climate

On the scale of 0 to 10 with 0 being least desirable and 10 as excellent policies, the 5 banks scored an average of 0.5 out of 10 for addressing climate change. HBL, Allied, MCB, Meezan and National Bank have not publicly disclosed any climate policies aligned with the Paris Agreement in banks’ lending and investment activities.

Failing on Labour and Human rights.

All five banks scored an average of 0.72 out of 10 in human rights policy ratings. None of the banks disclosed human rights policies related to their investment or financing, which raises concerns and is not aligned with the UN Guiding Principles on Business and Human Rights. Pakistan’s top 5 assessed commercial banks scored less than 1 out of 10 on labour rights policies and lack policy commitments to international labor rights standards or adherence to national laws for worker welfare. None of the assessed five commercial banks have formulated public labor rights expectations for their clients and investee companies. HBL, Meezan bank, Allied Bank, MCB and National bank of Pakistan have zero scores on nature and arms.

Gender equality a low priority With an average score of 1.48 out of 10, no commercial bank reported measures for equal participation and access to senior positions, with the highest reported representation of women on boards at 12.5%, significantly lower than the global average of 27.1% and falls short of the target of 50% set by SDG 5. None of the banks disclose how they apply a gender lens to their lending and investment activities.

Tax, Transparency & Accountability

The 5 banks assessed demonstrated low policy commitments on tax policies, primarily due to the lack of public disclosure on tax transparency. HBL, MCB, ABL, and Meezan Bank operate globally but have not disclosed any details regarding their profits, revenues, subsidies, or taxes in countries other than Pakistan, where they operate.

With an average score of less than 2 out of 10, none of the assessed banks disclosed transparency and accountability practices in the companies they invest in or finance. Risk control and grievance mechanism documentation were lacking in all five commercial banks assessed.

Notable progress in financial consumer protection and anti-corruption policies

The 5 banks scored highest on financial consumer protection (4.6 out of 10), followed by anti-corruption policies (3 out of 10). This suggests the commitment of the banks to fair treatment of and non-discrimination against their customers; however, none of the banks disclose any concrete measures taken towards the fair treatment of customers.

All five commercial banks have well-defined policies on disclosing bribery and implementing anti-money laundering measures, but they do not provide any disclosure concerning questions related to the companies they invest in or finance.