KARACHI, October 28 2024: In recent developments, a controversial fiscal measure has emerged: a higher tax on banking income derived from government securities. This tax is tied to the advance-to-deposit ratio (ADR), imposing an additional 10-15% charge on banks whose ADRs fall below 50% at the end of the banking year.

While the intention behind this policy is to encourage lending to the private sector, its main effect appears to be an increased tax burden on already profitable banks. Unfortunately, instead of driving banks to extend more private credit, this policy is causing significant distortions in the financial system.

A notable distortion is the growing disparity between the pricing of private credit risk and the risk-free rates of government securities. Major banks are now lending to government-supported entities like PASCO, TCP, and Punjab Food at discounts of 6-12% below the Karachi Interbank Offered Rate (KIBOR). Ironically, government borrowing rates for treasury bills often exceed these concessional rates for public sector borrowers, creating a puzzling misallocation of capital.

Corporate giants continue to be the primary recipients of private-sector lending, as banks fiercely compete to retain one another’s clients. In their rush to meet the ADR requirement and avoid additional taxes, banks are focusing on existing large borrowers rather than expanding credit access. With many banks’ ADRs lingering below 50% some even in the 20s, the effort to meet the threshold has become a numbers game.

To close a staggering Rs3.4 trillion lending gap, banks would need to achieve an unrealistic 30% increase in lending. The alternative is to reduce deposits, which undermines financial deepening, a critical goal for Pakistan’s banking sector. Rather than expanding financial inclusion, this policy forces banks to retract.

It’s as if banks are simultaneously pressing the accelerator and the brake. In response to the tax, some banks are employing creative, if questionable, strategies. High-net-worth clients are encouraged to swap deposits for investments in bank mutual funds or to directly invest in treasury bills, using these to secure low-interest loans. This practice creates additional inefficiencies and exacerbates inequality.

The policy appears to offer little benefit for small and medium-sized enterprises (SMEs), an important yet neglected part of the economy. Most banks are reluctant to pursue new borrowers due to high non-performing loans (NPLs), which currently stand at around Rs1 trillion.

Favourable court rulings for borrowers complicate loan recovery, prompting banks to prioritize large corporations over SMEs, which are crucial for broadening economic engagement and growth.

Furthermore, the ADR tax unintentionally encourages imports by providing cheap credit to large businesses, contradicting Pakistan’s monetary policy objectives aimed at reducing import-driven demand. Incentivizing private-sector lending should fall under the purview of the central bank, which possesses more effective tools.

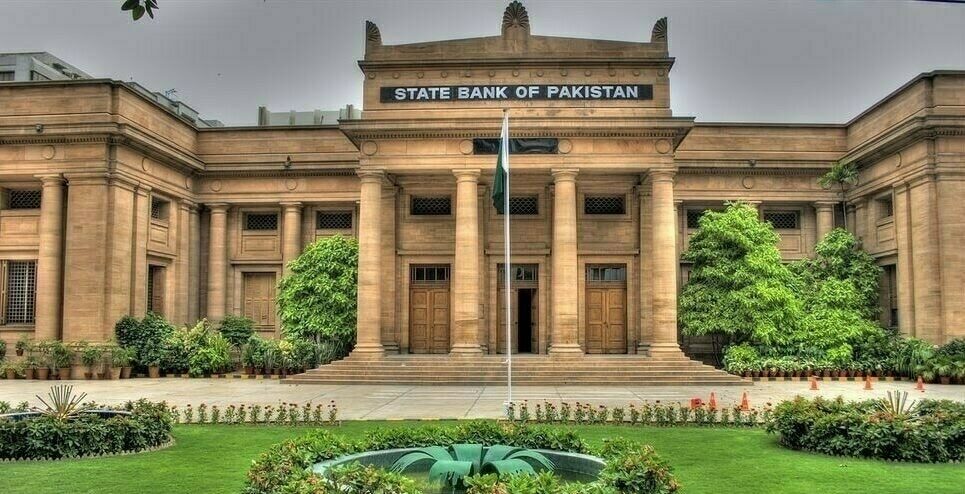

For instance, the State Bank of Pakistan (SBP) could impose capital charges on excessive government investments or adjust the Statutory Liquidity Requirement (SLR) to guide banks toward private-sector lending.

The reality is that the government’s increasing borrowing demands are a significant factor in the banks’ low ADRs. Domestic liquidity is strained, requiring the SBP to inject funds through open-market operations to sustain lending.

However, some large banks have taken advantage of this, extending government loans that exceed their deposit bases. A more focused policy could link capital charges to deposit levels rather than implementing broad tax increases, which dampen banking activities without achieving the desired fiscal outcomes.

As the tax year-end approaches, banks face pressure to manipulate their balance sheets artificially to meet ADR targets. This may lead to strategies like shedding deposits, issuing short-term loans, or using temporary measures such as issuing pay orders to adjust figures by December 30. To address these issues, the Federal Board of Revenue (FBR) plans to introduce a tax based on average ADRs for the next fiscal year, effectively embedding existing distortions into a continuous challenge.

As noted by economist Arthur Laffer, “The ultimate effect of taxation on the economy is best observed when the taxes themselves do not distort incentives but rather allow for the market to allocate resources most efficiently.”

Unfortunately, the government’s focus seems solely on increasing tax revenue. If that is the goal, a direct increase in the corporate tax rate on banks would be a simpler and more effective approach. Streamlining the tax system and allowing the SBP to manage credit allocation could enable Pakistan’s financial system to function as intended efficiently and poised for genuine growth.