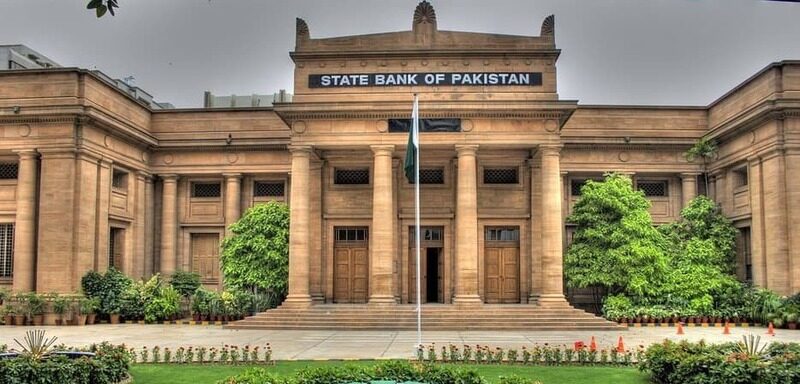

Karachi, November 19, 2024: BankIslami, a leading Islamic financial institution in Pakistan, recently joined forces with the State Bank of Pakistan (SBP) to celebrate Women Entrepreneurship Day across its branches nationwide. The event was attended by senior women officials from the SBP, who commended BankIslami for its proactive role in promoting financial inclusion for women.

As a bank committed to gender diversity and inclusivity, BankIslami aligns its operations with ethical banking practices, offering riba-free financial solutions that cater to a broad clientele. The bank’s vision, “Saving humanity from Riba,” reflects its dedication to making banking accessible and inclusive for all, irrespective of background or financial status.

The celebrations coincided with the SBP’s efforts to support women entrepreneurs through a series of initiatives designed to mentor, inspire, and enhance their access to finance. BankIslami has been a key supporter of these initiatives, including the EmpowerHER Finance Campaign launched by the SBP in July 2024. Under this campaign, BankIslami has disbursed Mashal Business Finance, a low-cost financing facility under the SBP’s Islamic Refinance and Credit Guarantee Scheme for Women Entrepreneurs (IRCGS-WE), aimed at new-to-bank women entrepreneurs to help them establish and expand their businesses.

Speaking at the event, Ms. Sara Sajjad, Deputy Chief Manager of the Financial Inclusion Division at the SBP Banking Services Corporation, praised BankIslami for its commitment to supporting female entrepreneurship. “BankIslami’s zeal to promote female entrepreneurship is evident from their highly effective sessions, attended by a diverse audience from various walks of life. I hope these efforts will play a key role in further strengthening female entrepreneurship, both large and small,” she said.

Ms. Ayesha Ashraf Jangda, Senior Manager at BankIslami’s Women Financial Services Department, also highlighted the challenges faced by women entrepreneurs, including limited access to subsidized financing and Islamic banking solutions tailored to their needs. “By celebrating Women Entrepreneurship Day, we aim to raise awareness about the financing available to women business owners, support the female entrepreneurial ecosystem, and contribute to the economic growth of Pakistan,” she added.

In addition to its ongoing initiatives, BankIslami recently signed a Technical Assistance Agreement with the Asian Development Bank’s Women’s Finance Exchange (gWFX) to pilot an alternative credit scoring technology. This partnership will enhance BankIslami’s ability to assess the creditworthiness of women entrepreneurs and women-owned small and medium enterprises (WSMEs), making the financing process more effective and inclusive.

Through these combined efforts, BankIslami and the SBP are working together to create a more inclusive financial ecosystem, empowering women entrepreneurs to thrive and contribute significantly to Pakistan’s economic development.