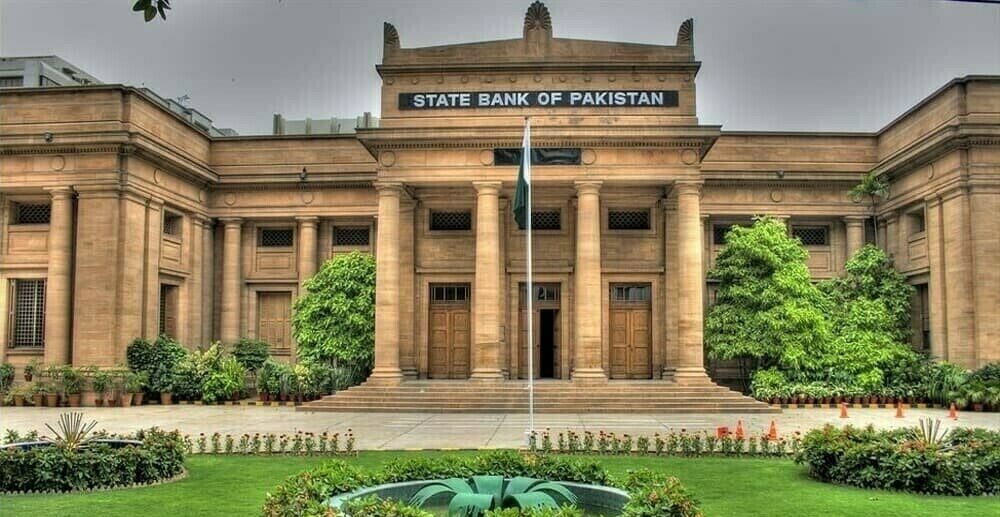

KARACHI, December 6, 2024: As the banking sector gears up for 2025, shifting dynamics are set to redefine the outlook for both conventional and Islamic banks. A key development is the State Bank of Pakistan’s (SBP) updated profit calculation framework for savings accounts, which will come into effect on January 1, 2025. This change is expected to provide relief to conventional banks, offering a cushion against potential interest rate suppression in CY25.

Conventional banks such as BOP, AKBL, and NBP are expected to lead the sector, with a slight profit recovery projected at 0.5%. However, excluding NBP, the sector’s earnings are expected to decline by 7.1%. Banks with high institutional deposit dependence stand to benefit the most, while Islamic banks like MEBL and FABL may face narrower profit margins due to the new challenges brought on by the SBP’s revised framework.

One of the significant changes for conventional banks is the removal of the Minimum Deposit Rate (MDR) for savings deposits from financial institutions, public sector enterprises, and public limited companies. This adjustment, effective from January 2025, is expected to significantly boost profitability. As of September 2024, the total local currency savings deposits held by banks under this coverage amounted to PKR 10.6 trillion, representing nearly 43% of total deposits. Banks in the coverage group are expected to see an average increase in profitability of PKR 4.93 per share for CY25, with BOP and AKBL seeing notable increases of 61% and 46%, respectively.

On the other hand, Islamic banks are facing new challenges as the SBP introduces a new MDR specifically for Islamic Banking Institutions (IBIs). Starting January 2025, IBIs will be required to offer at least 75% of the weighted average gross yield on their investment pools for PKR savings deposits, excluding those from financial institutions, public sector enterprises, and public limited companies. This calculation is expected to put pressure on banks like MEBL and FABL, potentially reducing their earnings by PKR 9 and PKR 1 per share, respectively, due to the revised profit calculation framework.

This shift in the regulatory landscape marks a pivotal moment for the banking sector in Pakistan, with conventional banks set to benefit from the changes, while Islamic banks must adjust to the new regulatory environment to maintain their profitability.