Banking

Bank Makramah forms strategic partnership with Avanza Solutions to empower future of banking with Novus Suite

Karachi, August 20, 2024: Bank Makramah Limited (BML) has entered into an agreement with Avanza Solutions to further strengthen their digital transformation initiatives, showcasing their dedication to implementing cutting-edge technologies to enhance customer interactions and optimize business processes. Under this partnership BML will benefit from Avanza’s leading Novus Suite platform. A signing ceremony was held…

Zindigi, The king’s trust international, and PAGE expand “The achieve” initiative to empower girls across Pakistan

Islamabad: Zindigi – Powered by JS Bank, The King’s Trust International, and the Pakistan Alliance for Girls Education (PAGE) have extended their efforts to empower young girls in Pakistan by signing a Memorandum of Understanding (MoU) to launch an expanded phase of “The Achieve Programme.” Achieve is a social and emotional learning Programme that aims…

Mobilink Bank revolutionizes financial independence for women with an industry-first inheritance calculator

Karachi, August 20, 2024: Pakistan’s leading digital microfinance bank, Mobilink Bank, has launched an easy-to-use in-app inheritance calculator made accessible through its Dost app. The cutting-edge financial tool is designed to empower individuals, especially women, by providing clear insights into their inheritance share. The calculator’s launch is a testament to the Bank’s commitment to promoting…

Faysal bank collaborates with EFU general to launch “Mehfooz ghar takaful plan”

Faysal Bank Limited (FBL) in collaboration with EFU General – WTO is proud to announce the launch of the “EFU Mehfooz Ghar Takaful Plan,” a groundbreaking house takaful plan designed to provide homeowners with unparalleled protection. Your home is more than just a structure, it is where your memories are made and cherished and that…

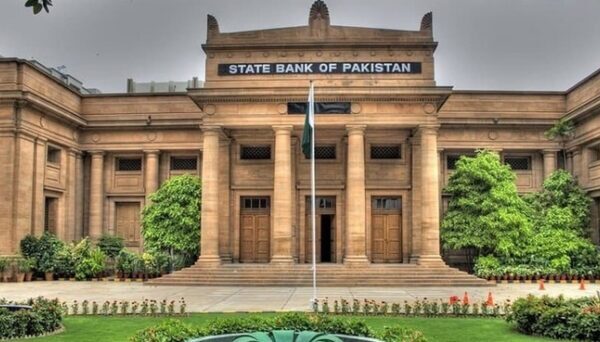

SBP injects over Rs900 billion into market

Karachi, August 17, 2024: The State Bank of Pakistan (SBP) injected Rs901.6 billion in the market on Friday through reverse repo purchase and Shariah Compliant Mudarabah based Open Market Operation (OMO). According to OMO results issued here, the SBP conducted Open Market Operation, Reverse Repo Purchase (Injection) on August 16, 2024 for 7-day and 28-day…