Economy

SBP Unveils annual report on Pakistan’s economy

KARACHI, October 17 2024: The State Bank of Pakistan (SBP) released the Annual Report on the State of Pakistan’s Economy for the fiscal year 2023-24 today. According to the Report, Pakistan’s macroeconomic conditions improved, supported by stabilization policies, successful engagement with the IMF, reduced uncertainty, and a favourable global economic environment. The increase in domestic…

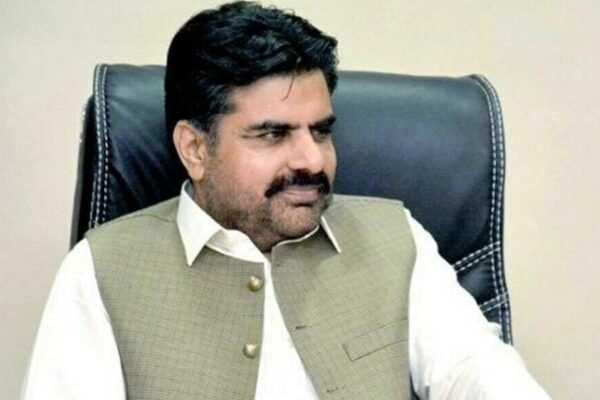

E-Commerce to boost sindh’s cultural heritage and support artisans

Karachi, October 17 2024: Provincial Minister for Industries and Commerce Jam Ikramullah Dharejo has said that the launch of Sindh Small Industries Corporation’s e-commerce website will promote Sindh’s cultural heritage and encourage artisans associated with this sector. He said this today while talking to the media on the occasion of the launch of Sindh Small…

Nasir Shah presides meeting on CSR initiatives

KARACHI, October 14 2024: Sindh Energy Minister Syed Nasir Hussain Shah has said that all the companies working in Thatta district regarding renewable energy have to improve their CSR initiatives for the welfare of the local people, a foundation will be established comprising of Sindh government, elected representatives, energy department and representatives of companies to…

SBP Implements new reporting requirements for authorized dealers

Karachi, October 11, 2024: The State Bank of Pakistan (SBP) has announced significant updates to the reporting requirements for Authorized Dealers in the foreign exchange market, following an amendment under Para 33 of Chapter 12 of the Foreign Exchange (FE) Manual. Effective immediately, Authorized Dealers are now required to submit specific statements . Appendix V-20…

Finance minister chairs key meeting on state-owned enterprises

Islamabad, October 11, 2024: Federal Minister for Finance and Revenue Senator Muhammad Aurangzeb presided over a crucial meeting of the Cabinet Committee on State-Owned Enterprises (CCoSOEs) today at the Finance Division. The meeting focused on enhancing the management and categorization of state-owned entities to improve their efficiency and effectiveness. A significant agenda item was the…