Lahore 1st Oct, 2023: Rashid Ashraf, the CEO of ACE Money Transfer, has suggested a multifaceted strategy to save the precious foreign exchange reserves of the country.

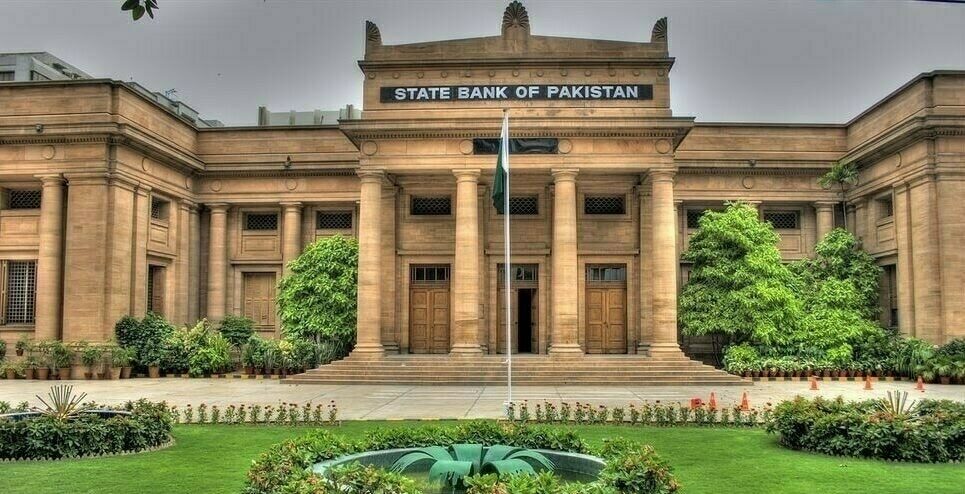

The State Bank of Pakistan last week reported that the nation’s overall foreign reserves amounted to $13,079.1 million. Pakistan’s foreign reserve levels have experienced a downward trend in recent months due to a number of contributing factors.

These include fiscal deficits, trade imbalances, inappropriate government spending, reduced remittances from overseas Pakistani citizens, an increase in debt obligations, and inefficiencies within the public sector organizations.

Low foreign reserves can put a country in a challenging position in the global markets, making it difficult to finance essential imports and maintain exchange rate stability. Several elements play a pivotal role in corroding Pakistan’s foreign reserves.

To begin with, the underground black market trading of USD has considerably drained the nation’s precious foreign exchange reserves. Furthermore, the persistent issue of widespread smuggling of oil and gold has compounded the problem by diverting foreign currency away from official channels.

Additionally, while import restrictions were initially implemented to safeguard foreign exchange, they have, on occasion, inadvertently increased the growth of informal networks and illicit black-market transactions.

Not only these, the discrepancy between interbank and open market exchange rates has created arbitrage opportunities, enticing Pakistani expatriates to utilize unofficial remittance channels, thereby intensifying the pressure on the country’s foreign reserve position.

Rashid Ashraf, the CEO of ACE Money Transfer, a regulated remittance provider playing a vital role in bringing much-needed inflows of remittances to Pakistan, says, that while the framework for addressing the challenges related to foreign reserves depletion exists, the essence of the solution is rooted in the effective enforcement and realization of existing policies and laws, which has been hampered by various underlying issues that the nation faces.

To safeguard Pakistan’s foreign reserves, a multifaceted strategy is imperative. Firstly, there is a pressing need to tighten border security. This involves the integration of advanced surveillance technology and infrastructure at border crossings to detect and deter smuggling activities effectively, he said.

Additionally, collaboration with higher authorities must be strengthened to facilitate the sharing of intelligence and coordinate operations, ensuring a unified front in addressing this issue.

Simultaneously, he said that efforts to combat smuggling must be intensified, with the imposition of stricter penalties and the launch of public awareness campaigns to clarify the inherent risks of engaging in illicit trade.

According to Rashid, to enhance the integrity of imports, the introduction of a proof-of-funds requirement at ports is vital to verify their legitimacy. Moreover, airports should escalate surveillance measures to efficiently combat smuggling and other financial crimes, while the public should be incentivized to report any such activities they come across, he added.

“The black money entering Pakistan through illegal channels has now captured a significant share of remittances that could have entered the country through legitimate channels. The country’s high demand for black money, driven by motives such as tax evasion, corruption, and illegal activities, continues to drive the flow of illicit funds through these unofficial channels” says Rashid Ashraf.

To enhance foreign remittances, the key strategy involves leveraging official banking channels, which play a pivotal role as the first line of defense, he mentioned. Banks should conduct regular reviews of their clients, emphasizing a risk-based approach rationalizing their transactional activities with sources of income.

Moreover, clients identified as lacking sufficient adherence to regulations should face the possibility of account termination and reporting to law enforcement and revenue agencies. Besides this, the regularization of the gold market, curbing of oil and dollar smuggling, and establishment of proof of fund requirement for imports are also pivotal.

He said that these concerted efforts aim not only to curb illegal money transfers but also to encourage the utilization of legitimate channels for remittances, ultimately contributing to the bolstering of Pakistan’s foreign reserves.

These strategic initiatives, if successfully implemented, hold the potential to create a more conducive environment for international trade and investment in Pakistan, likely leading to increased exports and foreign investments, thereby protecting the country’s foreign reserves, he said.

‘’These measures, specifically designed to curb smuggling, boost legitimate imports, and encourage remittances, could yield a remarkable surge in annual revenue compared to the current financial landscape. Such an infusion of funds would not only strengthen Pakistan’s foreign reserves but also significantly contribute to overall economic stability and growth’’, Rashid added.