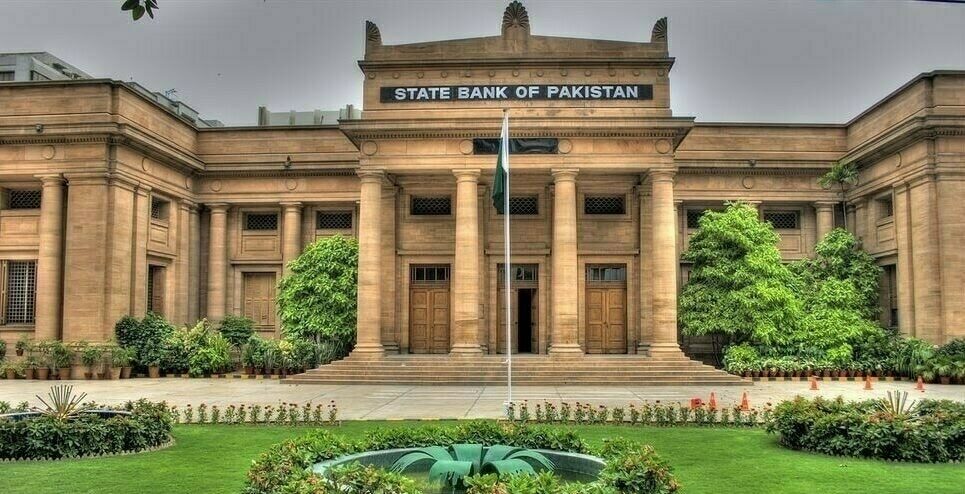

Karachi, October 23, 2024: Speaking at the SCB Global Majlis 2024 in Karachi, the Deputy Governor of the State Bank of Pakistan (SBP) delivered a decisive message on the nation’s future financial system. He announced that Pakistan must transition completely to an Islamic financial framework by December 2027, per a constitutional mandate. This directive leaves no room for the continuation of the interest-based banking system.

The shift, described as a legal and ethical imperative, marks a critical juncture in Pakistan’s financial history. The Deputy Governor emphasized that banks, businesses, and financial institutions must urgently begin preparing for this new reality, which is seen as crucial for fostering a fairer and more sustainable economy.

This move follows a broader national and global trend towards ethical and Islamic finance, which prioritizes risk-sharing and discourages speculative practices. Pakistan aims to align its economic policies with Islamic principles, ensuring that its financial operations avoid interest (Riba), which is prohibited in Islam. The announcement underscores the commitment to transforming Pakistan’s financial system into one that reflects its religious and constitutional values