Karachi, November 1, 2024: United Bank Limited (UBL) has officially submitted an offer to amalgamate Silkbank Limited with itself, as part of a strategic initiative aimed at enhancing its market presence and operational efficiency.

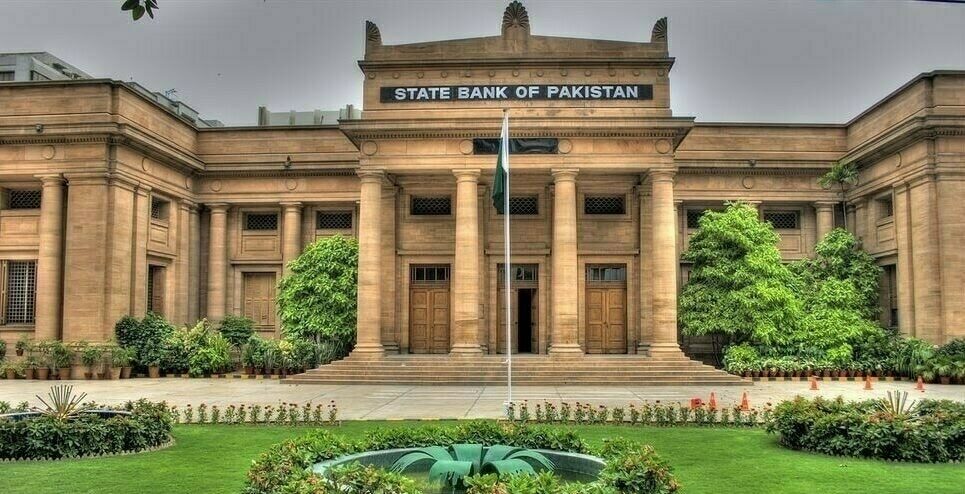

The proposed amalgamation will be executed under a scheme to be filed with and sanctioned by the State Bank of Pakistan (SBP) under Section 48 of the Banking Companies Ordinance, 1962.

In April of last year, UBL notified its stakeholders that it was exploring a potential merger with Silkbank Limited and planned to seek approval from the State Bank of Pakistan (SBP) to initiate due diligence. At that time, UBL emphasized that the potential merger would be contingent upon thorough due diligence, as well as the necessary internal and regulatory approvals and the execution of definitive agreements.

Subsequently, the Board of Directors at Silkbank Limited authorized management to formally pursue the proposed merger with UBL, signalling a significant step forward in the potential integration of the two banks.

Now on Friday, in a notice released to the Pakistan Stock Exchange (PSX) according to Sections 96 and 131 of the Securities Act, 2015, UBL outlined the terms of the offer. As part of the amalgamation, UBL intends to issue and allot new ordinary shares to Silkbank shareholders at a ratio of one (1) new UBL ordinary share for every three hundred and twenty-five (325) ordinary shares of Silkbank.

This proposal is contingent upon the approval of UBL’s Board of Directors and shareholders, as well as the execution of definitive transaction documents between UBL and Silkbank. Additionally, the amalgamation requires the receipt of all necessary corporate, regulatory, and third-party approvals.

BL has committed to keeping the Exchange updated on any significant developments regarding this transaction as they arise. This strategic move marks a notable step in UBL’s growth strategy, reflecting its ongoing commitment to strengthening its position in the banking sector.