KARACHI, January 30th 2025: In an era where Pakistan’s small businesses are already struggling under inflation and economic uncertainty, a new Federal Board of Revenue (FBR) regulation has added fuel to the fire. Notification 55(i)/2025, which mandates small traders to file exhaustive stock reports, purchase details, and monthly sales tax returns, has been met with fierce opposition from the Karachi Chamber of Commerce & Industry (KCCI).

KCCI President Muhammad Jawed Bilwani has raised alarms over the new compliance requirements, stating that small traders, wholesalers, and importers—many of whom rely on minimal manpower—are simply incapable of meeting these complex tax demands. “They operate on tight profit margins and cannot afford dedicated tax professionals, yet FBR expects them to file detailed stock reports with HS code-wise classifications,” Bilwani remarked.

The business community has been vocal about the increasing burden of documentation, which, instead of easing tax compliance, is making it nearly impossible for many businesses to operate. Karachi, already grappling with law and order issues, high inflation, and dwindling investment, is now witnessing a new wave of frustration as small businesses fear non-compliance penalties.

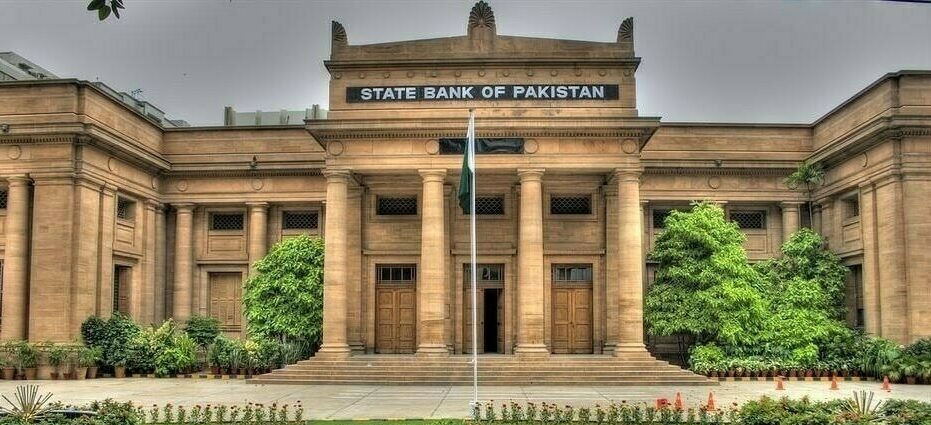

Meanwhile, in a contrasting move aimed at facilitating businesses, Governor of the State Bank of Pakistan (SBP), Jameel Ahmad, highlighted positive developments in SME financing and agricultural credit disbursement. Speaking at the Multan Chamber of Commerce and Industry (MCCI), he pointed out that SME loans had surged from Rs543 billion in December 2023 to Rs638 billion by December 2024. Furthermore, agricultural credit grew by 14.5%, reaching Rs1,266 billion in the first half of FY25.

Despite these monetary policy efforts, the growing regulatory burden on small traders could counteract any financial relief offered by the SBP. As Bilwani urged, the FBR must reconsider its approach, shifting to an annual reporting system instead of monthly filings, to prevent pushing small businesses to the brink of collapse. The ball is now in the FBR’s court—will it ease the burden, or will small businesses continue to suffocate under regulatory pressure?